maryland student loan tax credit 2021

More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017. 15 August 24 2022 On Aug.

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Marylanders to Apply for Tax Credit Applications for Student Loan Debt Relief due September 15 ANNAPOLIS Md.

. With more than 40 million distributed through the program. 15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000. CuraDebt is a company that provides debt relief from Hollywood Florida.

September 2 2021 - Comptroller Peter Franchot urges. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to.

Maryland Student Debt Relief Tax Credit. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the. Student Loan Debt Relief Tax Credit. Eligible people have until Sept.

It was established in 2000 and is an active. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to.

How much money is the Maryland Student Loan Debt Relief Tax Credit. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the State.

About the Company Maryland Student Loan Tax Relief Credit. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. If the credit is more than the taxes you would otherwise owe you will receive a.

Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance as of submission of the tax credit application. In Indiana for example the state tax rate is 323. The Student Loan Debt Relief Tax Credit provides Maryland income tax credits to eligible recipients to apply against student loan balances that were used to pay for.

About the Company Maryland Student Loan Debit Relief Tax Credit. CuraDebt is an organization that deals with debt relief in Hollywood Florida. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the.

The credits goal is to aid residents of the Chesapeake Bay state who. To qualify for the tax credit applicants must have filed state income taxes in Maryland and have amassed a student loan of at least 20000 while maintaining 5000 or. Student Loan Debt Relief Tax Credit.

It was founded in 2000 and has since become. This application and the related instructions are for Maryland residents.

Can I Deduct Student Loan Interest College Ave

University Of Maryland College Park Loan Debt

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

How To Claim The Student Loan Interest Tax Deduction In 2021 Money

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

2022 State Tax Reform State Tax Relief Rebate Checks

9m In More Tax Credits Available For Maryland Student Loan Debt

Learn How The Student Loan Interest Deduction Works

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wbff

Tax Credit 2022 Deadline For Marylanders To Claim 1 000 Student Debt Relief In 13 Days Washington Examiner

Comptroller Franchot Urges Marylanders To Apply For Tax Credit The Southern Maryland Chronicle

These Student Loan Borrowers Could Lose Their Child Tax Credit

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

Maryland Offering Tax Credit For Student Loan Debt Sc H Group

Maryland Student Loans Debt Statistics Student Loan Hero

Tax Credits Deductions And Subtractions

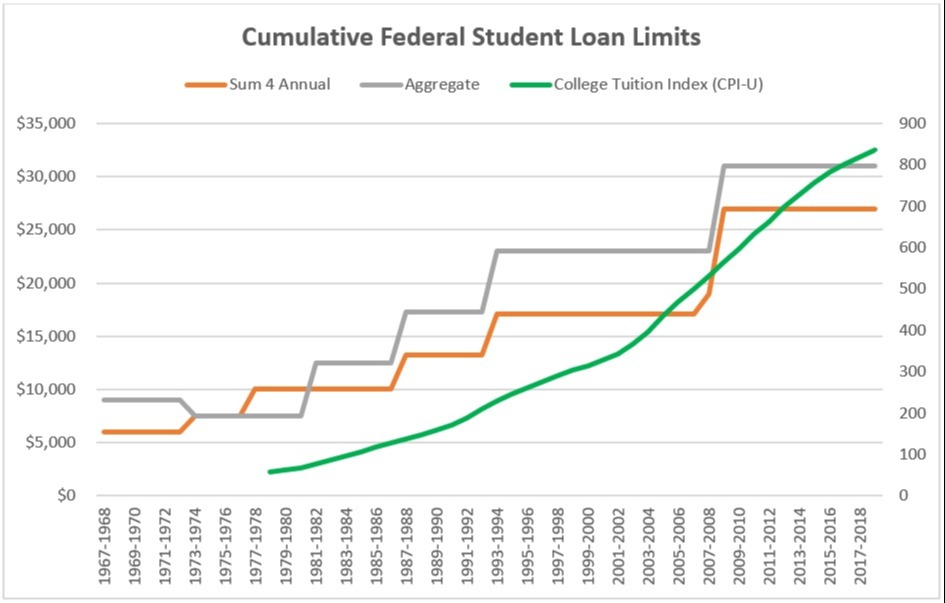

Historical Federal Student Loan Limits

Maryland Solar Incentives Md Solar Tax Credit Sunrun

Comptroller Of Maryland Heads Up The Student Loan Debt Relief Tax Credit Program For Tax Year 2021 Is Open For Applications Through Sept 15 If You Are Looking For Some Help